Q4 Market Update: Neutral Alcohols

As we conclude the fourth quarter of 2024, we are pleased to share the latest developments at Sasma, including market insights, industry trends, and updates on our product offerings. Your continued partnership is invaluable to us, and we are committed to providing you with timely and relevant information to support your business endeavours.

Neutral Alcohols Market Overview

The neutral alcohols market, encompassing commodities such as sugarcane alcohol, Extra Neutral Alcohol (ENA), and wheat alcohol, has experienced significant fluctuations in Q4 2024. These changes are primarily influenced by variations in grain and sugar prices, freight rates, production costs, and energy expenses.

Grain Prices

Europe

In Q4 2024, global grain prices have exhibited notable volatility. In Europe, wheat prices have been particularly affected due to climatic challenges and shifts in cultivation patterns. Farmers are holding onto their crops, waiting for better prices, leading to a supply crunch for distillers. This situation makes distillers vulnerable to potential price upswings, especially as global reserves are expected to reach a nine-year low (Market Watch).

North America

In North America, wheat production has faced challenges due to adverse weather conditions, impacting supply levels. Farmers are reducing wheat planting by up to 30% due to rising costs, decreased subsidies, and lower profit margins (Market Watch).

Asia

In Asia, wheat production is projected to increase due to an expansion in the sowing area. However, actual yields will depend on favorable weather conditions, with concerns about summer drought and lack of autumn moisture affecting winter crop development (Market Watch).

Sugar Prices & Their Impact in Distillers

In 2024, global sugar prices have experienced significant volatility due to factors such as adverse weather conditions, government policies, and market dynamics. In August, fires in Brazil's sugarcane fields, exacerbated by prolonged droughts, led to concerns over reduced sugar production, contributing to price fluctuations (Reuters).

Concurrently, India extended its sugar export ban to boost local supplies and ethanol output, tightening global supply and influencing market prices (Reuters).

These developments have impacted distillers worldwide, as higher sugar prices increase production costs for sugar-based ethanol, affecting profitability and operational decisions. In the European Union, the sugar sector has faced challenges due to market liberalization and price volatility, prompting discussions on policy measures to support producers and ensure market stability (European Parliament).

Freight Rates

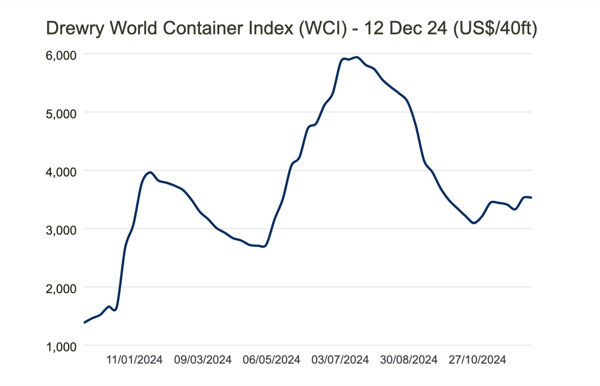

The freight industry in 2024 experienced significant volatility, driven by inflation, energy costs, and geopolitical tensions, which strained global supply chains. The Drewry World Container Index (WCI) stabilized at $3,529 per FEU by December, 66% below the 2021 pandemic peak but still 148% higher than 2019 pre-pandemic levels. Rates spiked mid-year due to increased demand and supply disruptions but eased in the latter months as markets adjusted. Key routes such as Shanghai to Rotterdam and Shanghai to Genoa saw moderate rate increases, while Shanghai to Los Angeles experienced notable declines, reflecting regional demand fluctuations. Despite these challenges, the market showed signs of stability toward year-end, with Drewry forecasting spot rates to remain steady into early 2025.

Source: Drewry

Implications for the Neutral Alcohols Market

The interplay of these factors—volatile grain and sugar prices, fluctuating freight rates, and rising energy costs—has a direct impact on the production and pricing of neutral alcohols. Producers are navigating increased operational expenses, which may influence supply chains and pricing strategies. Staying informed about these market dynamics is crucial for stakeholders to make strategic decisions in this evolving landscape.

Related articles

-

Meet Sasma’s New Warehouse Manager in Halsteren

Mark shares his background, his vision for safe & efficient operations, and how Halsteren will serve as a natural...Read more -

Is Ethyl Alcohol Halal?

Ethyl alcohol is widely used acrossmany supply chains, where it primarily serves as a functional ingredient rather than...Read more -

Sasma 2025 Year in Review

As we close out Q3, we share the key developments shaping our industry: global trade agreements & tariff shifts,...Read more -

Sasma Halsteren Facility On Track To Open April 2026

Sasma’s new Halsteren warehouse is progressing as planned, marking a significant investment in our long-term...Read more -

Exploring Bulk Whisky with Sasma: Quality, Customization, & Expertise

Understanding the factors shaping bulk alcohol pricing is crucial. Learn how raw materials, production processes, and...Read more -

.jpg?width=790&height=980&name=sasma-apr25-websize-366%20(1).jpg)

What Is A CAS Number and Why Is It Important?

Quality at Sasma more than a standard we adhere to. we're suppliers of bulk spirits & alcohol, from sourcing and...Read more